Industries are under pressure to cut emissions. Regulations keep getting tougher. Customers and investors want greener operations. It's not simple, but it's necessary. This blog talks about how companies are…

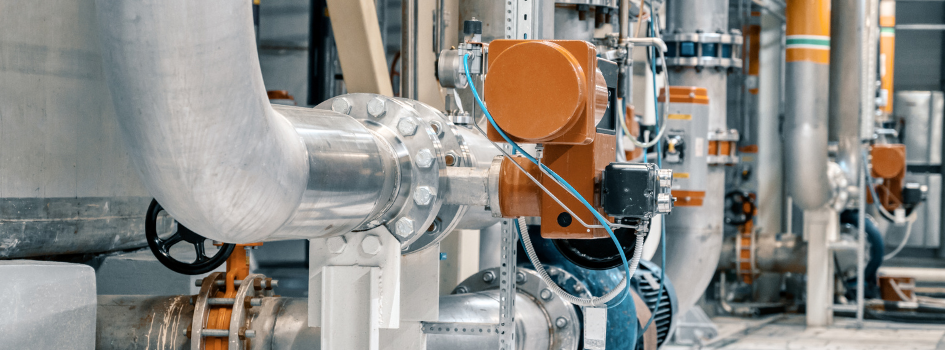

is a global solution provider of modular process skids for liquid and gas process systems. These units are fully optimized “Engineered-to-Order” turnkey modular systems which ship ready to “plug into” the process flow at your plant.

IFS designs and manufactures a wide range of modular process systems for several industries. Some of IFS’s most popular packages include NOx Reduction for air quality control, Fuel Gas Conditioning for combustion turbines and boilers, mini gas-to-liquids plants for stranded natural gas, just to name a few.

With a sales group comprised entirely of engineers, we can speak processing engineering fluently with you, which makes things happen more quickly and smoothly for all involved.

However complicated your project, IFS process engineers will build-to-design according to your specifications. In the end, IFS will deliver the completed package optimized, certified, installed, and performance guaranteed for use anywhere in the world.

With up to 25 process engineers on staff, we build about 140 skid-mounted packages a year with most of them installed overseas. Let us build yours.

Industries are under pressure to cut emissions. Regulations keep getting tougher. Customers and investors want greener operations. It's not simple, but it's necessary. This blog talks about how companies are…

Chemical dosing systems help move chemicals into a process-automatically, accurately, and on schedule. They're used everywhere from water treatment to industrial manufacturing. The ultimate goal is to keep things consistent…

Getting the flow rate right helps your pump meet demand, keeps your system running smoothly, and can extend equipment life. In this guide, we'll walk through how to calculate flow…

The process of starting up industrial equipment for the very first time can be incredibly challenging. More frustrating is the possibility that some vital components may fail and affect your…

For more information about our Skid-Mounted Modular Process Systems, please call 1-800-795-4068 or send us an